Named one of the top 5 tax preparation apps in the App Store by Mobilewalla. (March 23, 2012.)

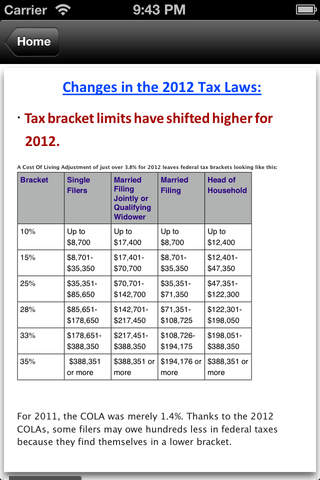

Updated for your 2012 tax returns and information on changes that will affect your 2013 tax return.

The MUST have app to help you save money on this years taxes!! Make sure you are getting every deduction you are entitled to maximize your refund!

Have you ever:

Been out to dinner with a client?

Been sent to a company convention by your employer?

Started a part time business?

Incurred unexpected medical expenses for you or a family member?

Enrolled in a college class or was sent to training by your employer?

Borrowed money for your education?

Paid alimony to an ex-spouse?

Just bought your first home?

Hired a tax preparer?

If so, then you need this “iDeductible” app for your iPad or iPhone.

This app will tell you whether the above situations, or any of the other 250+ situations discussed in the app, are deductible on your income taxes, and where to report these deductions. It is laid out in a simple to use format reviewing deductions in the following four categories:

Employment Deductions - This category will include travel, education, and job expenses and what the limitations are on the items that are deductible (or what criteria you need to satisfy so the expenses will be deductible).

Self-Employed Deductions - This category discusses the tax code’s definition of what self employed taxpayers can deduct and lists several common deductions you can use whether you are self employed full time, part time, or as an independent contractor.

Personal Deductions - This category reviews over 150 personal expenses you may have during the year, whether they are deductible, and where to report them on your tax return (including almost 100 different types of medical expenses).

Investment Deductions - This category discusses the money you spend while trying to make money, including a section on real estate rental properties.

This App is written according to the current year’s tax laws and will be updated as new laws are passed or new IRS regulations written. It has been created to serve as a quick reference on planning for your 2013 tax return.

The author of this App has been in the Tax Consulting Business since 1979 and has both worked for major tax firms and been self employed in his own tax business.

Disclaimer: This App is designed to give you a general tax knowledge of what deductions are allowed by the Tax Code. It is not meant to substitute for professional advice concerning how these deductions apply your individual tax situation. Always consult a tax professional on any questions concerning your individuals taxes.